Warren Buffett, known as the “Oracle of Omaha,” is one of the most successful investors in history and the chairman and CEO of Berkshire Hathaway. His investment portfolio is renowned for its long-term strategy, value investing principles, and focus on fundamentally strong companies. Here are key aspects of his portfolio:

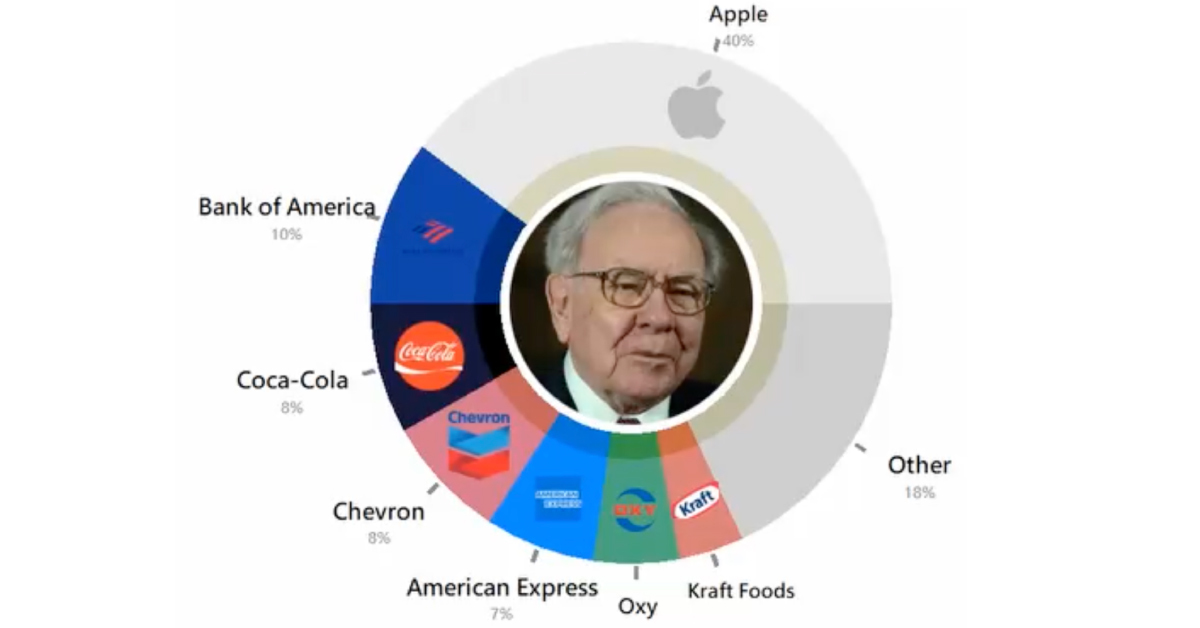

- Core Holdings: Buffett’s portfolio includes significant stakes in well-known companies such as:

- Apple Inc.: One of the largest positions, reflecting his belief in the company’s strong brand and growth potential.

- Coca-Cola: A long-term investment, emphasizing Buffett’s preference for companies with strong consumer brands and consistent earnings.

- American Express: A financial services leader, demonstrating his confidence in the brand and its business model.

- Diverse Sectors: Buffett invests across various sectors, including:

- Consumer Goods: Brands like Kraft Heinz and Procter & Gamble.

- Financial Services: Major holdings in Bank of America and Wells Fargo.

- Energy: Investments in companies like Chevron and Occidental Petroleum.

- Philosophy: Buffett focuses on companies with:

- Strong Competitive Advantages: Brands, patents, or unique business models that allow them to maintain profitability.

- Solid Management: He looks for trustworthy and competent leaders.

- Valuation: Investing in companies that are undervalued relative to their intrinsic worth.

- Long-Term View: Buffett is known for holding investments for the long term, often years or decades. He believes in the potential for compounding returns over time.

- Recent Trends: In recent years, he has shown interest in technology companies, reflecting a shift from his earlier skepticism about tech investments. His increased stake in Apple is a prime example.

ALSO READ :- https://virenbrew.com/nvidia-shares-surge-after-ceo-highlights-demand-for-blackwell-ai-superchip/

Buffett’s investment philosophy emphasizes patience, thorough research, and the importance of understanding what you’re investing in. His portfolio reflects these principles, focusing on sustainable, long-term growth rather than quick gains.

Conclusion

In conclusion, Warren Buffett’s investment portfolio exemplifies his commitment to value investing and a long-term perspective. By focusing on fundamentally strong companies with competitive advantages, sound management, and reasonable valuations, he has achieved remarkable success over the decades. His strategic diversification across various sectors, particularly his recent embrace of technology, highlights his adaptability in a changing market landscape. Ultimately, Buffett’s approach serves as a valuable lesson for investors: thorough research, patience, and a clear understanding of one’s investments are key to building wealth over time.

Follow us on INSTAGRAM – https://www.instagram.com/virenbrew/

Follow us on TWITTER (X) – https://x.com/VIRENbrew

Follow us on LINKEDIN – https://linkedin.com/in/viren-brew-230415328/

Follow us on FACEBOOK – https://www.facebook.com/profile.php?id=61565127137999

Follow us on YOUTUBE – https://www.youtube.com/@VIRENbrew

No responses yet